When one-person/nonemployer business owners consider the possibility of bringing on their first worker, it is imperative that CPAs and tax advisers get involved early on because there are many things to consider and help guide them through. This article will detail exactly how to determine worker classification status, but also discuss why it matters.

Aside from the usual factors such as what tasks will the worker perform, how much will they be paid, when will they work, etc., the business owners will also need to determine the worker’s classification. In other words, should the worker be a 1099 independent contractor or a W-2 employee? This decision is not always easy or clear-cut and cannot be done arbitrarily. It is extremely important because it can have a myriad of unintended or adverse consequences that may never be able to be undone later if the initial assessment is incorrect.

Control Concerns

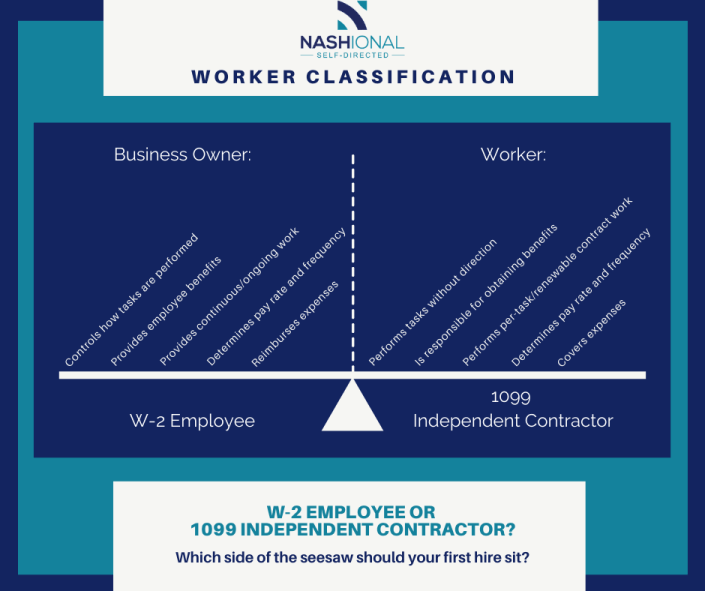

The primary factor that the business owner will need to address concerns control – how much control will the business owner exert over the worker? The more control they have, the more likely the worker would be an employee. The less control they have, the more likely the worker would be an independent contractor.

There are three Common Law Rules that can provide guidance as to the degree of control that the employer will have versus independence that the worker will have: behavioral, financial, and type of relationship.

Common Law Rules

1. Behavioral

Does the business owner have the right to control what and how the worker does his or her job? If the business owner has control over how the worker performs the tasks assigned, then this points to an employee status.

2. Financial

Who controls things like how and how much the worker is paid, whether expenses are reimbursed, who provides tools/supplies, etc.? If the worker states the rate that he or she will be paid for the tasks performed, expenses are not reimbursed, and the worker must supply his or her own supplies, then this points to an independent contractor.

3. Type of Relationship

Is there a written contract that outlines the work to be performed, is training offered, or are there employee-type benefits, such as health insurance, vacation pay, etc.? Will the relationship continue and is the work performed a key aspect of the business? If benefits are provided, it points to an employee. If the relationship will continue, but on a per-task or a renewal system that is outlined in a written contract, this points to an independent contractor.

The Key in How to Determine Worker Classification Status

The key is to look at all three rules and the entire relationship, consider the degree, or extent, of the right to direct and control, and finally, to document each of the aspects used in coming up with the determination.

If, after considering everything above, it is still unclear whether the worker should be an employee or independent contractor, Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding (PDF) can be filed with the IRS by either the business owner or the worker. Once received, the IRS will review the facts and circumstances to make an official determination of the worker’s status.

Independent Contractors

Independent contractors are the simplest type of worker to hire. This person will need to provide the business owner with a completed Form W-9 when he or she first comes on board, and the business owner must file Form 1099—NEC and provide a copy of it to the independent contractor annually, generally in January, for the preceding tax year. The business owner is not responsible for paying any employment tax on behalf of the independent contractor.

Employee

Having an employee, on the other hand, will require the business owner to collect Form I-9 and Form W-4 from the worker when they start and then prepare, and provide them with, Form W-2 at the conclusion of each tax year. They must also deposit and report employment taxes on the employee’s behalf.

This includes the tax withholdings from the employee’s pay as well as a matching amount for his or her Social Security and Medicare taxes that the business owner is responsible for paying themselves. This is an increased cost that the business owner may not have been expecting. More information about the various employment taxes and reporting requirements can be found here.

Worker Classification Status – Retirement Implications

Having an employee as opposed to an independent contractor also affects the type of retirement plan that the business owner can adopt. If they have employees over age 21 that work more than 1,000 hours per year (full-time), and they want to take part in a retirement plan, the options that are available, such as a traditional 401(k), require that the plan be made available to the employees. Retirement plans that include employees are very common and a great option for many businesses, but they have some limitations, like lower contribution limits. They can also create additional administrative expenses that a very small business owner cannot afford yet.

If the business owner only has independent contractors, however, they are able to adopt a one-participant retirement plan, like a Self-Directed Solo 401(k), that offers higher income tax deferral/contribution limits, more investment options, and a great deal of freedom without incurring high administration fees to open or operate it. The independent contractor can then set up his or her own Self-Directed Solo 401(k) plan and enjoy the same benefits themselves.

How to Determine Worker Classification Status – Summary

Since independent contractors are easier administratively and less expensive workers, (due to the Social Security and Medicare tax match,) many business owners try to classify a person as an independent contractor when they should really be an employee. This is very unwise. If the business owner is found to have misclassified a worker with no reasonable basis for doing so, he or she could be liable for that worker’s employment taxes. See IRS Publication 4341 for more information.

This is why starting off on the right worker classification path with the first person is an important decision that should not be rushed or made without proper advice. It not only sets the tone for their tenure, but also future workers and how they will need to be classified. In addition, this determination affects the business owner’s tax obligation on behalf of the worker and their ability to contribute up to $57,000 or $63,500 (depending on age), in 2020 of their own income to help defer their tax liability via a one-participant retirement plan.

For more small business topics, check out this section of the site.

Source and Additional Information:

Independent Contractor or Employee? https://www.irs.gov/businesses/small-businesses-self-employed/independent-contractor-self-employed-or-employee

Pingback: What Kind of Worker Are You? Job Classifications for Tax Purposes -

Pingback: What Kind of Worker Are You? Job Classifications for Tax Purposes – Job-99.com

Pingback: What Kind of Worker Are You? Job Classifications for Tax Purposes – Recruitology Careers Blog

Pingback: What Kind of Worker Are You? Job Classifications for Tax Purposes – | महा जॉब्स

Pingback: What Kind of Worker Are You? Job Classifications for Tax Purposes – – Udemy Discount Coupon Demo

Pingback: What Kind of Worker Are You? Job Classifications for Tax Purposes – – Udemy Discount Coupon Demo

Pingback: Bookkeeping Mistakes to Avoid in Commercial Real Estate -

Pingback: How You Can Use Technology to Enhance Your Business - The Daily CPA